RSI

RSI(相対力指数)とはテクニカルチャートの一種であり買われすぎか、売られすぎかを判断するための指標です。

ここではpythonでRSIを計算し、過去に買われすぎと判断された状況で株価がどうなったかをグラフで見てみようと思います。

import numpy as np

import pandas as pd

import mplfinance as mpf

from utils import get_finance_data

# 銘柄名、期間、保存先ファイル

ticker_symbol = "NVDA"

start = "2021-05-01"

end = "2021-06-30"

# データを取得する

df = get_finance_data(ticker_symbol, start=start, end=end, savedir="../data")

df.head()

| High | Low | Open | Close | Volume | Adj Close | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2021-04-30 | 153.649994 | 149.970001 | 151.744995 | 150.095001 | 20191200.0 | 149.990234 |

| 2021-05-03 | 152.467499 | 147.875000 | 151.250000 | 148.367493 | 20391200.0 | 148.263931 |

| 2021-05-04 | 146.375000 | 140.102493 | 146.372498 | 143.512497 | 40532400.0 | 143.412323 |

| 2021-05-05 | 148.134995 | 143.875000 | 147.089996 | 144.585007 | 29202400.0 | 144.484070 |

| 2021-05-06 | 145.712494 | 142.179993 | 144.952499 | 145.229996 | 19338000.0 | 145.128616 |

RSIを求める

RSIには様々な計算方法があり[1]、ここではRelative Strength Index (RSI)で示されている方法で計算してみます。

def get_rsi(close_prices: pd.Series, n=14):

"""RSI(相対力指数)を計算する

RS=(n日間の終値の上昇幅の平均)÷(n日間の終値の下落幅の平均)

RSI= 100 - (100 ÷ (RS+1))

参考文献:

- https://info.monex.co.jp/technical-analysis/indicators/005.html

- https://www.investopedia.com/terms/r/rsi.asp <-- 以下のコードの記号はこのページのものを使用

Args:

close_price (pd.Series): 終値の系列

days (str): n日間, optional, default is 14.

Returns:

rsi(pd.Series): RSI

"""

close_prices_diff = close_prices.diff(periods=1)[1:]

fist_n_days_diff = close_prices_diff[: n + 1]

previous_average_gain, previous_average_loss = 0, 0

rsi = np.zeros_like(close_prices)

for i in range(len(close_prices)):

if i < n:

previous_average_gain = fist_n_days_diff[fist_n_days_diff >= 0].sum() / n

previous_average_loss = -fist_n_days_diff[fist_n_days_diff < 0].sum() / n

rsi[i] = 100.0 - 100.0 / (1 + previous_average_gain / previous_average_loss)

else:

if (cpd_i := close_prices_diff[i - 1]) > 0:

current_gain = cpd_i

current_loss = 0.0

else:

current_gain = 0.0

current_loss = -cpd_i

previous_average_gain = (previous_average_gain * (n - 1) + current_gain) / n

previous_average_loss = (previous_average_loss * (n - 1) + current_loss) / n

rsi[i] = 100.0 - 100.0 / (1 + previous_average_gain / previous_average_loss)

return rsi

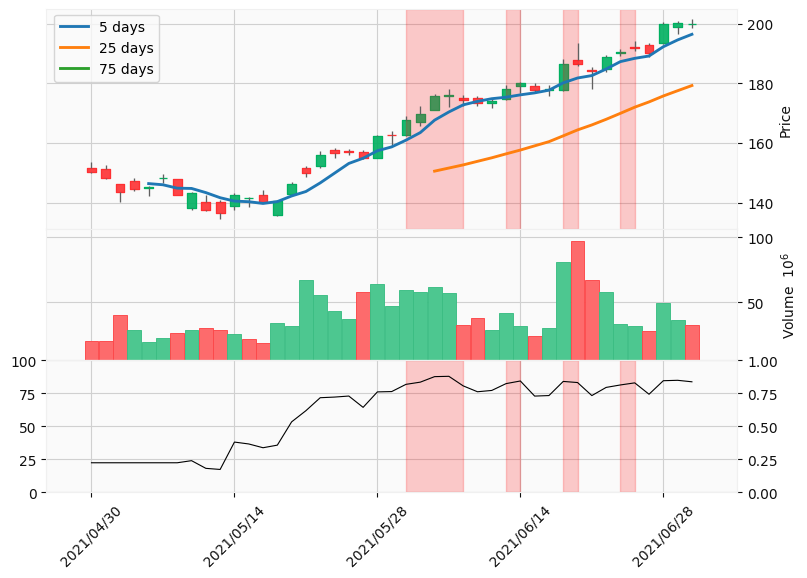

OHLC チャートと並べてプロットする

df["rsi"] = get_rsi(df["Close"], n=7)

# RSIのグラフを追加する

apd = mpf.make_addplot(

df["rsi"], panel=2, color="#000", ylim=(0, 100), secondary_y=True, width=0.8

)

# グラフを作成

fig, axes = mpf.plot(

df,

type="candle",

style="yahoo",

volume=True,

mav=[5, 25, 75],

addplot=apd,

panel_ratios=(1, 0.6),

datetime_format="%Y/%m/%d",

returnfig=True,

figscale=1.2,

)

fig.legend(

[f"{days} days" for days in [5, 25, 75]], bbox_to_anchor=(0.0, 0.78, 0.305, 0.102)

)

<matplotlib.legend.Legend at 0x7fdeaf404130>

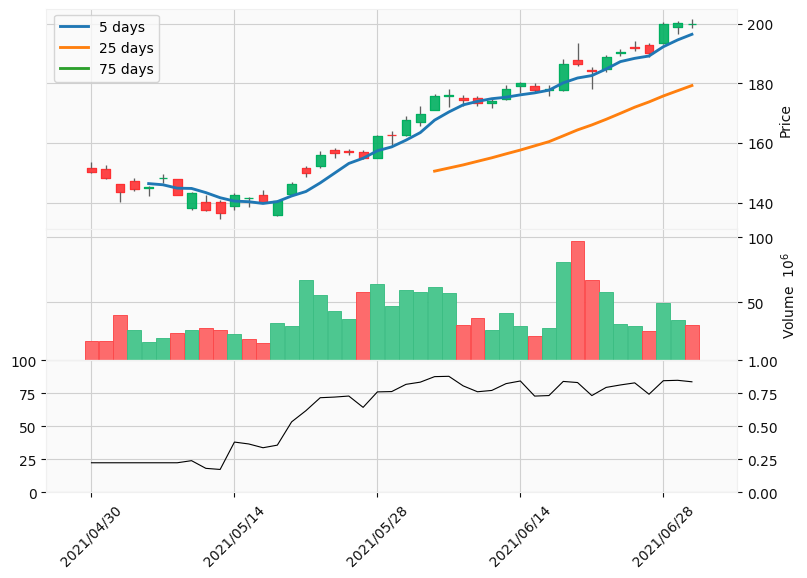

条件を満たした範囲を塗りつぶす

「RSIが●×以上になった」「価格が●×を超えた」など、条件が満たされた期間を塗りつぶしてわかりやすくしたいです。 ここでは、80を超えた区間を塗りつぶしてみます。

塗りつぶし範囲の区間のリストを作る

cond_true_spans = []

span = None

is_true_span = False

for i, rsi_i in enumerate(df["rsi"]):

if rsi_i > 80 and not is_true_span:

is_true_span = True

span = [i, 0]

elif rsi_i < 80 and is_true_span:

is_true_span = False

span[1] = i - 1

cond_true_spans.append(span)

else:

pass

グラフの塗りつぶしをする

apd = mpf.make_addplot(

df["rsi"], panel=2, color="#000", ylim=(0, 100), secondary_y=True, width=0.8

)

fig, axes = mpf.plot(

df,

type="candle",

style="yahoo",

volume=True,

mav=[5, 25, 75],

addplot=apd,

panel_ratios=(1, 0.6),

datetime_format="%Y/%m/%d",

returnfig=True,

figscale=1.2,

)

fig.legend(

[f"{days} days" for days in [5, 25, 75]], bbox_to_anchor=(0.0, 0.78, 0.305, 0.102)

)

for span in cond_true_spans:

axes[0].axvspan(span[0], span[1], color="red", alpha=0.2)

axes[-1].axvspan(span[0], span[1], color="red", alpha=0.2)