ETFと利回りを比較

代表的なETFと債権利回りの推移を比較します。データは

stooqから取得したものを取得しています。

『メディアプログラミング入門 WebスクレイピングとWebAPI』の講義資料45pで紹介されていたPandas Datareaderを使用しています。

import numpy as np

import pandas as pd

import pandas_datareader.data as web

import matplotlib.pyplot as plt

import japanize_matplotlib

from IPython.display import display, HTML

from utils import get_finance_data, get_rsi

ETF

# 銘柄名、期間、保存先ファイル

start = "2021-08-01"

end = "2022-01-31"

# データを取得する

voo = get_finance_data("VOO", source="stooq", start=start, end=end)

display(HTML(f"<h3>VOO</h3>"))

display(voo.head())

vti = get_finance_data("VTI", source="stooq", start=start, end=end)

display(HTML(f"<h3>VTI</h3>"))

display(vti.head())

spx = get_finance_data("^SPX", source="stooq", start=start, end=end)

display(HTML(f"<h3>S&P500</h3>"))

display(spx.head())

ndq = get_finance_data("^NDQ", source="stooq", start=start, end=end)

display(HTML(f"<h3>Nasdaq</h3>"))

display(ndq.head())

VOO

| Open | High | Low | Close | Volume |

|---|

| Date | | | | | |

|---|

| 2022-01-31 | 405.67 | 413.9700 | 404.3500 | 413.69 | 9200435 |

|---|

| 2022-01-28 | 397.82 | 406.3300 | 393.3000 | 406.26 | 12096807 |

|---|

| 2022-01-27 | 402.93 | 405.9700 | 394.8200 | 396.54 | 12455226 |

|---|

| 2022-01-26 | 405.66 | 408.1954 | 394.3400 | 398.56 | 14377346 |

|---|

| 2022-01-25 | 398.17 | 404.2600 | 392.7325 | 399.46 | 16836326 |

|---|

VTI

| Open | High | Low | Close | Volume |

|---|

| Date | | | | | |

|---|

| 2022-01-31 | 222.09 | 226.950 | 221.22 | 226.81 | 5306436 |

|---|

| 2022-01-28 | 217.50 | 222.170 | 214.93 | 222.09 | 4961209 |

|---|

| 2022-01-27 | 220.81 | 222.400 | 215.90 | 216.75 | 5791524 |

|---|

| 2022-01-26 | 222.72 | 224.160 | 216.05 | 218.37 | 7096416 |

|---|

| 2022-01-25 | 219.10 | 222.015 | 215.64 | 219.22 | 6600378 |

|---|

S&P500

| Open | High | Low | Close | Volume |

|---|

| Date | | | | | |

|---|

| 2022-01-31 | 4431.79 | 4516.89 | 4414.02 | 4515.55 | 2960132803 |

|---|

| 2022-01-28 | 4336.19 | 4432.72 | 4292.46 | 4431.85 | 2926083817 |

|---|

| 2022-01-27 | 4380.58 | 4428.74 | 4309.50 | 4326.51 | 3070684348 |

|---|

| 2022-01-26 | 4408.43 | 4453.23 | 4304.80 | 4349.93 | 3239353450 |

|---|

| 2022-01-25 | 4366.64 | 4411.01 | 4287.11 | 4356.45 | 3069079477 |

|---|

Nasdaq

| Open | High | Low | Close | Volume |

|---|

| Date | | | | | |

|---|

| 2022-01-31 | 13812.20 | 14242.90 | 13767.71 | 14239.88 | 3268652504 |

|---|

| 2022-01-28 | 13436.71 | 13771.91 | 13236.55 | 13770.57 | 3092819850 |

|---|

| 2022-01-27 | 13710.99 | 13765.91 | 13322.66 | 13352.78 | 3373437394 |

|---|

| 2022-01-26 | 13871.77 | 14002.65 | 13392.19 | 13542.12 | 3664304374 |

|---|

| 2022-01-25 | 13610.87 | 13781.63 | 13414.14 | 13539.29 | 3265336637 |

|---|

債権利回り

usy10 = get_finance_data("10USY.B", source="stooq", start=start, end=end)

display(HTML(f"<h3>10-Year U.S. Bond Yield</h3>"))

display(usy10.head())

usy2 = get_finance_data("2USY.B", source="stooq", start=start, end=end)

display(HTML(f"<h3>2-Year U.S. Bond Yield</h3>"))

display(usy2.head())

10-Year U.S. Bond Yield

| Open | High | Low | Close |

|---|

| Date | | | | |

|---|

| 2022-01-31 | 1.789 | 1.816 | 1.771 | 1.780 |

|---|

| 2022-01-28 | 1.830 | 1.848 | 1.773 | 1.777 |

|---|

| 2022-01-27 | 1.840 | 1.851 | 1.783 | 1.799 |

|---|

| 2022-01-26 | 1.769 | 1.876 | 1.769 | 1.867 |

|---|

| 2022-01-25 | 1.753 | 1.792 | 1.735 | 1.776 |

|---|

2-Year U.S. Bond Yield

| Open | High | Low | Close |

|---|

| Date | | | | |

|---|

| 2022-01-31 | 1.1986 | 1.2145 | 1.1587 | 1.1827 |

|---|

| 2022-01-28 | 1.2141 | 1.2260 | 1.1603 | 1.1703 |

|---|

| 2022-01-27 | 1.1822 | 1.2061 | 1.1603 | 1.1882 |

|---|

| 2022-01-26 | 1.0313 | 1.1603 | 1.0154 | 1.1544 |

|---|

| 2022-01-25 | 1.0055 | 1.0353 | 0.9897 | 1.0254 |

|---|

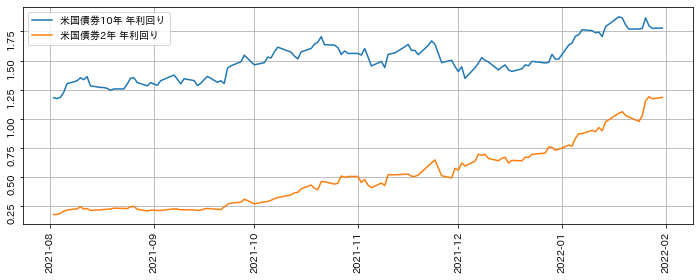

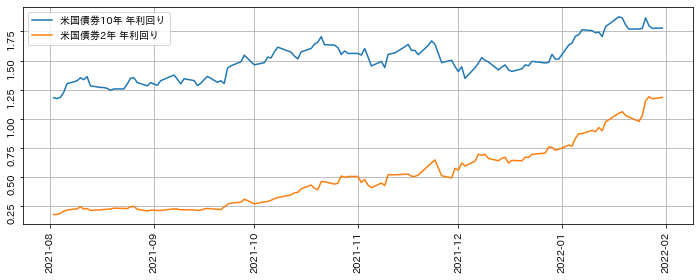

plt.figure(figsize=(12, 4))

plt.plot(usy10.Close, label="米国債券10年 年利回り")

plt.plot(usy2.Close, label="米国債券2年 年利回り")

plt.legend()

plt.tick_params(rotation=90)

plt.grid()

plt.show()

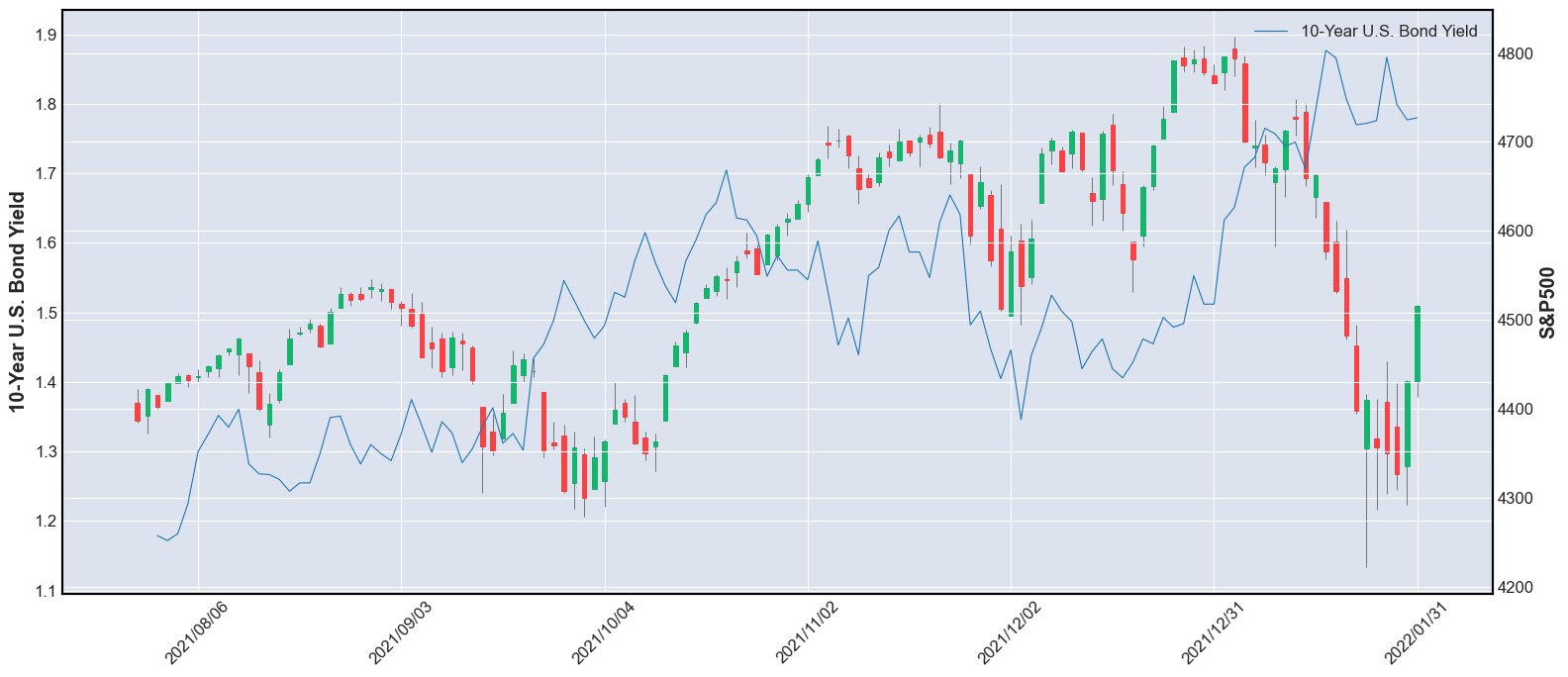

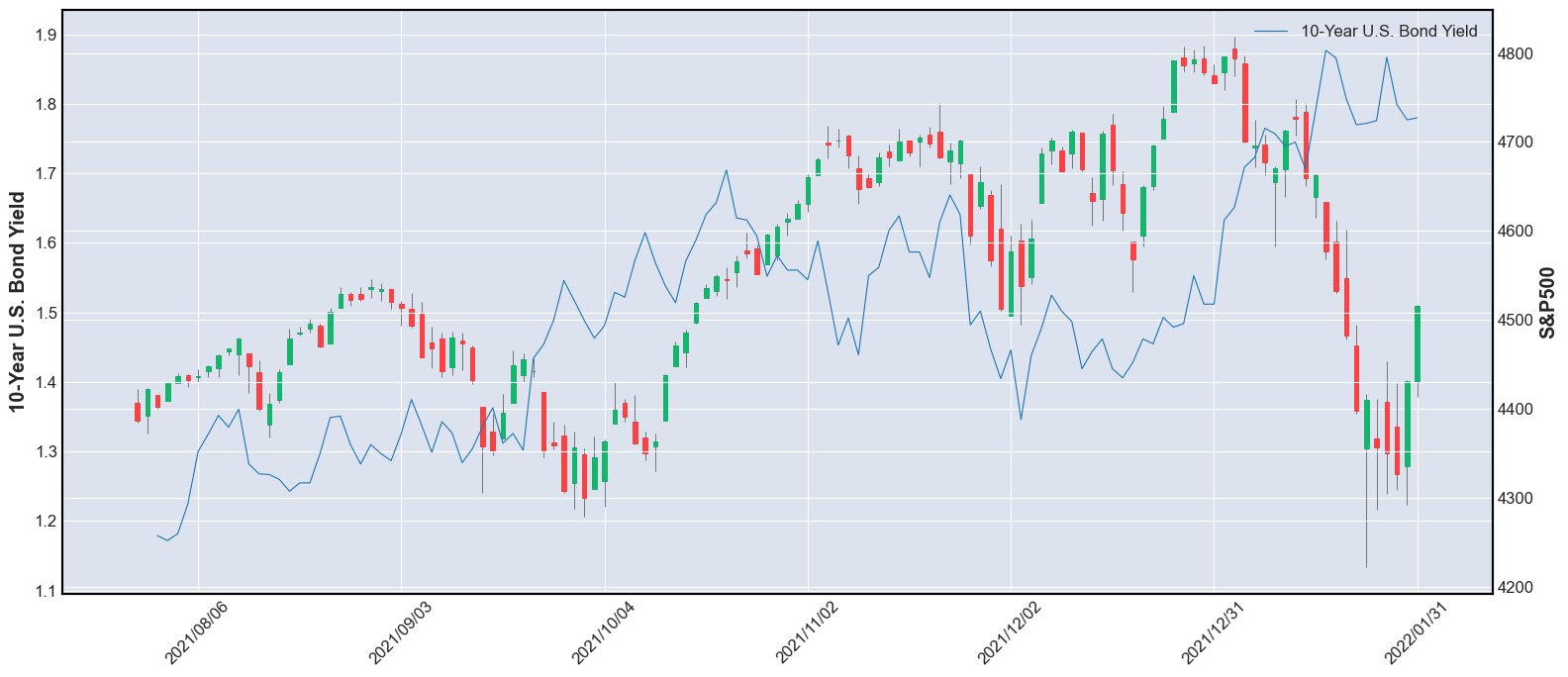

S&P500と10年債利回りの比較

import mplfinance as mpf

fig = mpf.figure(figsize=(16, 7), tight_layout=True, style="default")

ax1 = fig.add_subplot(111)

ax2 = ax1.twinx()

mpf.plot(spx, type="candle", style="yahoo", datetime_format="%Y/%m/%d", ax=ax1)

ax1.set_ylabel("S&P500")

ax1.invert_xaxis()

mpf.plot(

usy10,

type="line",

style="starsandstripes",

datetime_format="%Y/%m/%d",

ax=ax2,

)

# 左側にラベルを表示する

ax2.tick_params(labelleft=True, labelright=False)

ax2.set_ylabel("10-Year U.S. Bond Yield")

ax2.yaxis.set_label_position("left")

ax2.legend(["10-Year U.S. Bond Yield"])

<matplotlib.legend.Legend at 0x7fcc4de60970>